OAK at London Climate Action Week 2025: from volatility to opportunity

Raphaelle Vallet

Head of Sustainability

OAK climate leaders discuss key themes for the (re)insurance industry from London Climate Action Week.

London Climate Action Week (LCAW) is one of the world’s most dynamic gatherings of climate leaders, convening voices across finance, policy, and industry. For us at OAK, it was energising to be part of so many conversations at the intersection of climate, risk, resilience, and innovation.

This year, we joined events hosted by partners including Howden, Aon, Lloyd’s and the Geneva Association to help tackle some of the most urgent questions facing the (re)insurance industry. Reflecting from the week, we observed three standout themes.

From canaries in the coal mine to drivers of resilience

(Re)insurers can evolve their role from risk transfer to supporting the design of projects at the outset to maintain insurability over the long-term.

Our founder and CEO Cathal Carr spoke at Howden’s De-Risking Summit, which brought together influential voices from the real economy to the financial system. (Re)insurers often face the impacts of climate-driven risks before the rest of the financial system. Stranded asset risk can correlate with declining insurability; for example, where home owners cannot access or afford insurance, they may also feel repercussions on the affordability of mortgages and house prices.

“The climate continues to warm. That is causing multiple effects, including increased frequency and severity of extreme weather events. That increase in risk and volatility creates pressure on our ability as an industry to understand those risks and price them appropriately, then passing on that confidence to our investors that we can allocate capacity to help solve these challenges.”

Cathal Carr, Founder and CEO, OAK Re

At the same time, real economy firms at the Summit mentioned challenges in being recognised and incentivized by their insurers to invest in resilience, while the investment community still looks to increase the speed and scale of investments into infrastructure – the core asset class driving sustainable outcomes, from lower emissions to improved resilience.

“We’re looking to scale up our infrastructure financing around the world very substantially over the next several years… As we finance deals, we need to distribute those risks, [including] through insurance.”

Sir Danny Alexander, CEO of Infrastructure Finance and Sustainability at HSBC

(edited for brevity)

We were proud to contribute to Howden’s latest report The Insurability Imperative, which reframes the role of our industry in this direction.

Unlocking the bankability of emerging technologies

As new energy technologies progress towards commercialisation and scale, they will also need clear pathways to insurance.

Glenn O’Halloran, Transition Class Lead, participated in a session on insuring scalable growth in fusion energy hosted by Lloyd’s and President of Innovation Strategies, Tom Dickson, also spoke at a Geneva Association session on challenges and opportunities around insuring carbon capture, utilisation and storage (CCUS). As these advanced energy systems edge toward commercial viability, tailored risk frameworks and insurance capacity will become crucial to maintain support from investors and policy-makers.

Investing in talent

Across the sessions we joined, one theme kept surfacing: talent.

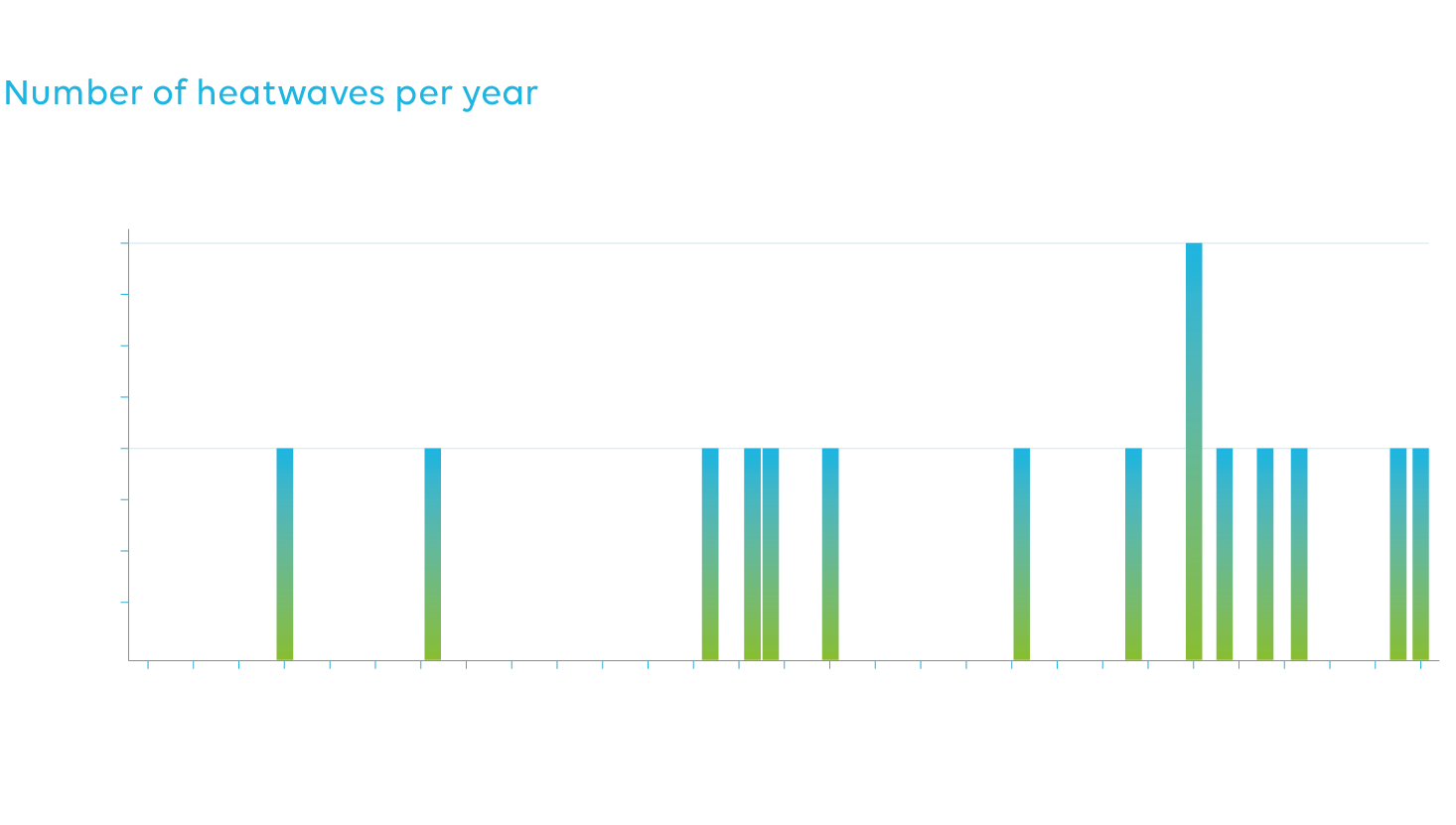

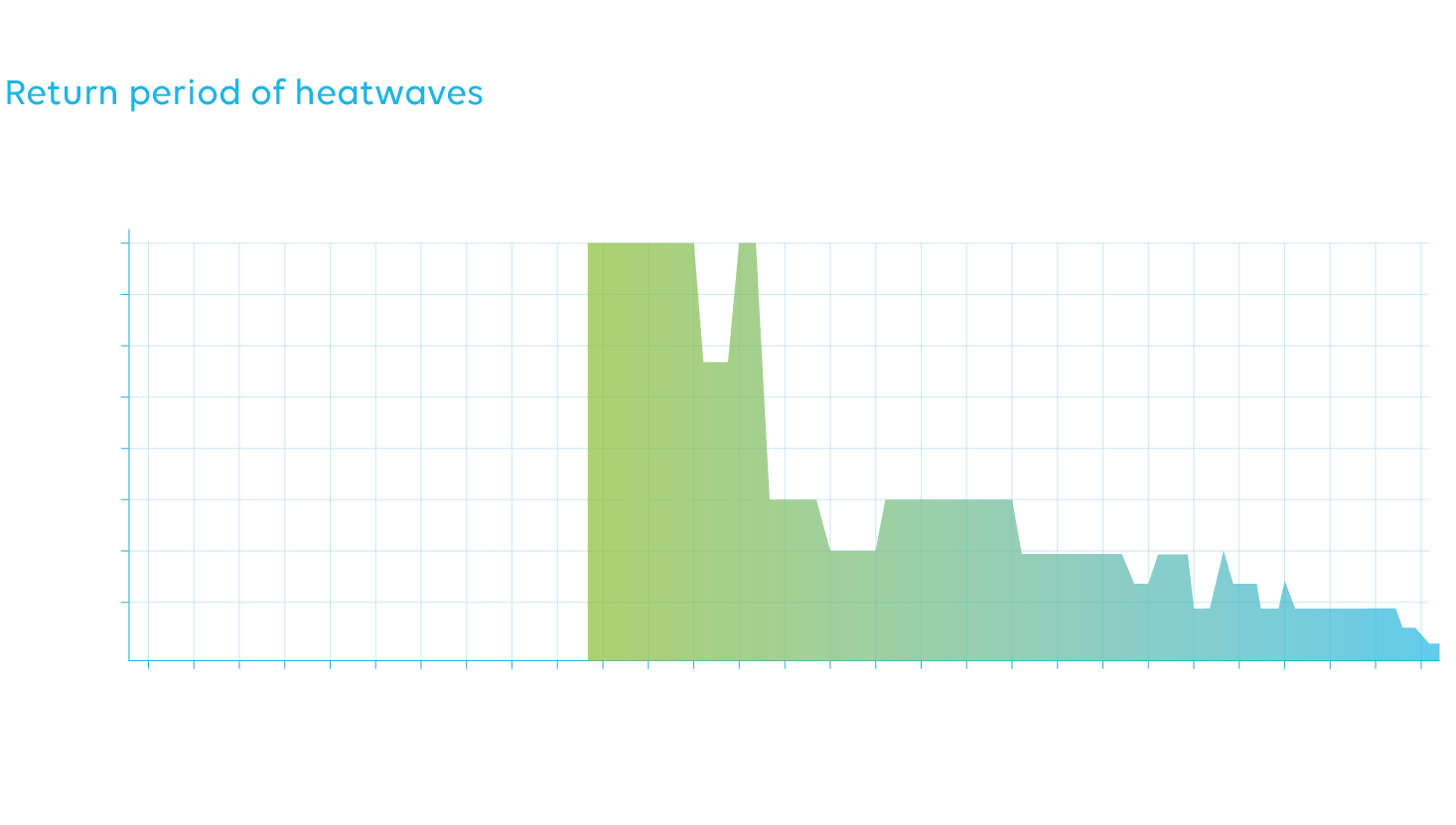

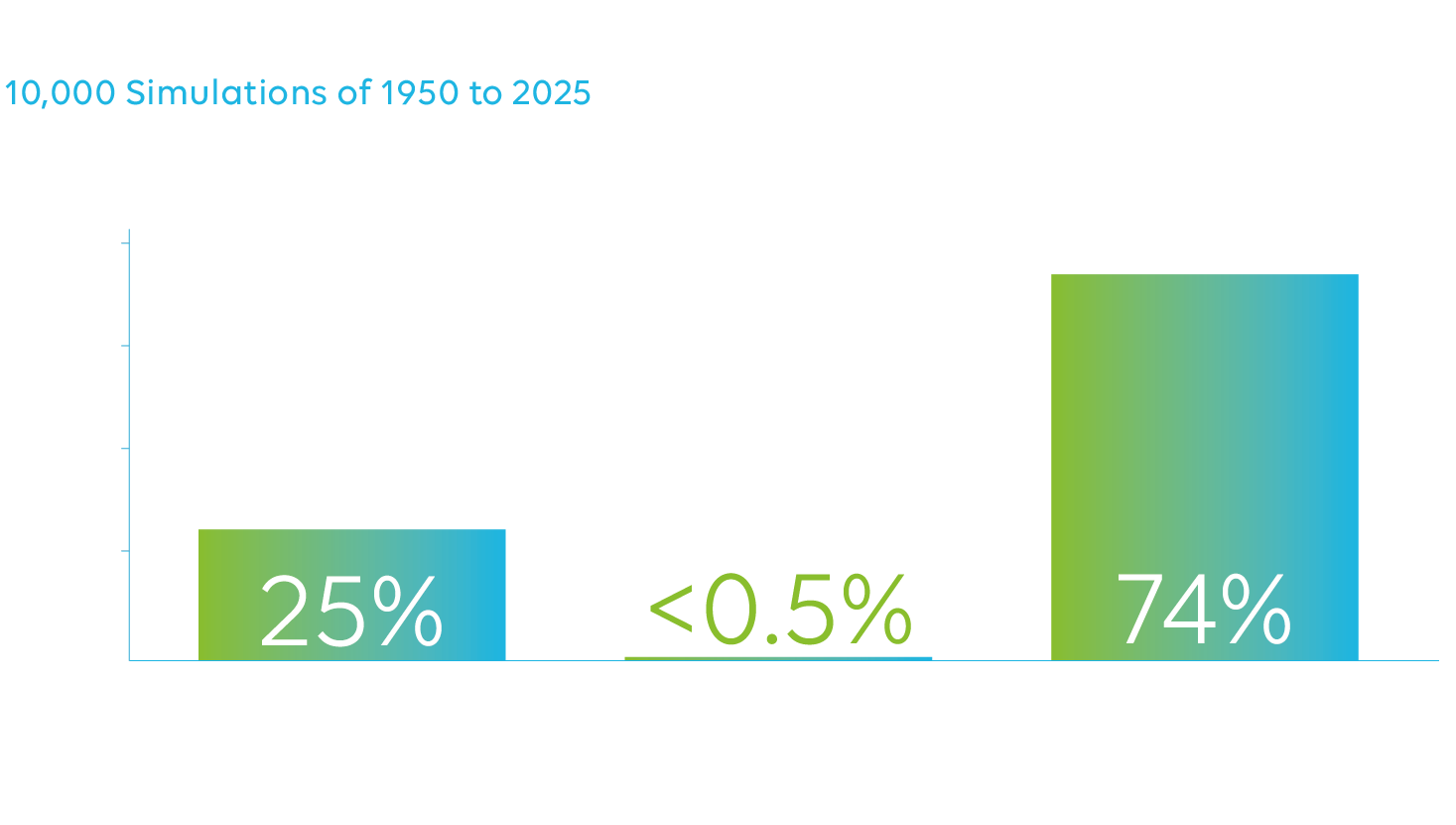

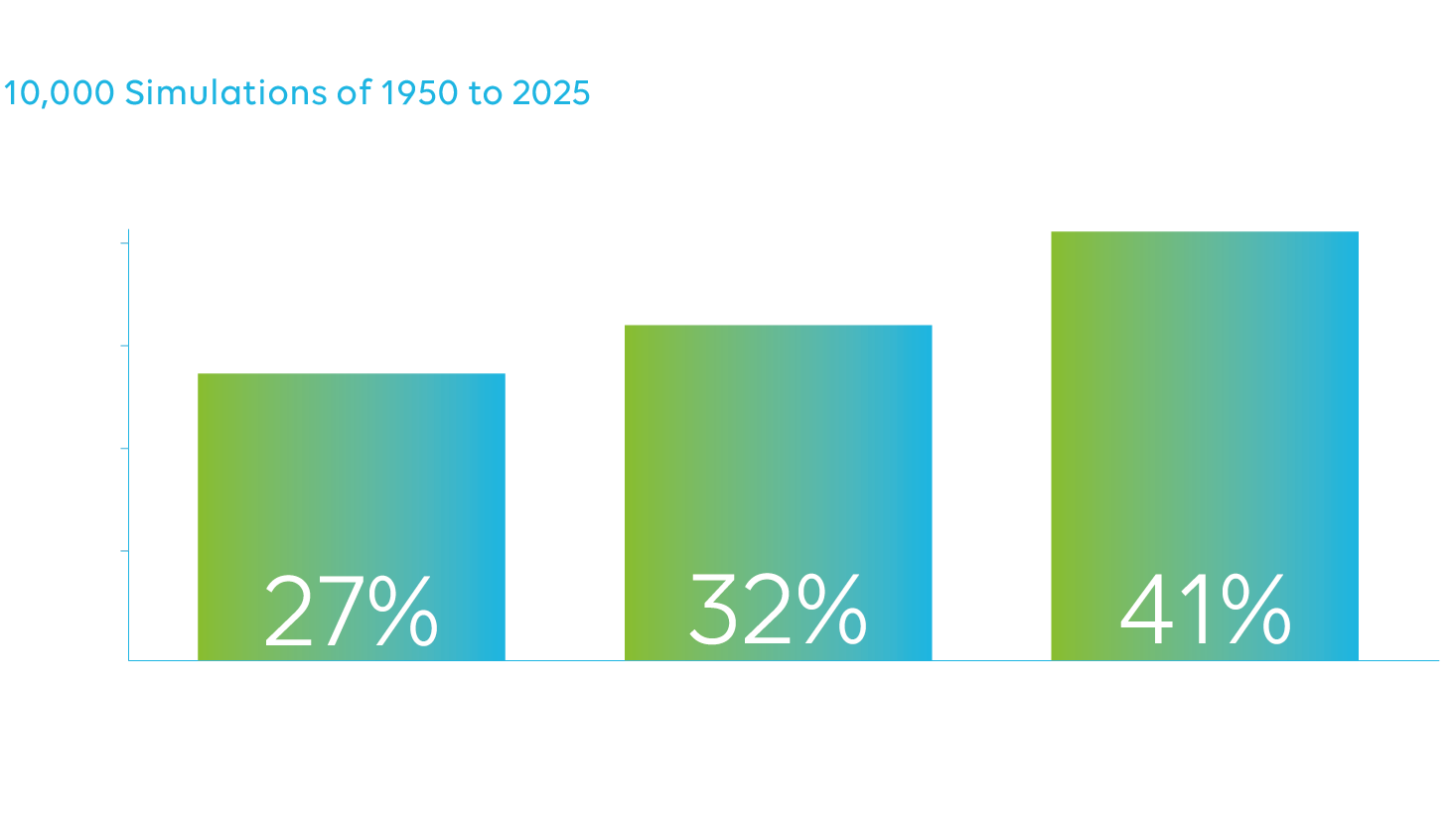

Climate-driven risks are becoming more complex: the frequency and severity of extreme weather events and disasters are increasing faster than model projections, while new technologies, infrastructure and software are reshaping the energy system into one that is more distributed, flexible, and technically sophisticated.

In a roundtable on insuring the energy transition hosted by Aon, Glenn O’Halloran and Hugo Buckmaster, International Property Catastrophe Class Lead, discussed the risk expertise challenges our industry faces as physical and transition risks continue to evolve. We are in a race to build expertise to address climate-driven risks – and, just as importantly, seize opportunities.

Turning insight into action at OAK

Our time at LCAW was a reminder of the possibilities when the right people, ideas, and tools come together.

At OAK, we believe climate represents a significant opportunity that will allow us to create sustainable value for investors. As part of our own journey to build deep climate expertise, we have brought together a multidisciplinary team spanning transition and climate underwriting, catastrophe research, sustainability, data science, and modelling.

With this multi-disciplinary team, we are working to tackle these industry challenges in improving resilience and insurability and unlocking capital for new technologies.

For example, we adjust standard CAT models to better reflect the present-day risk landscape — recognising that climate change is already shifting the severity and frequency of perils. We are helping create new pathways to insurability for high-potential, high-impact technologies — supporting product development and working with partners to bring new insurance solutions to market for assets like battery storage, CCUS, and solar PV.

As we are seeking to meet new insurance demands for physical and transition risks, we have developed a proprietary Climate Opportunity Framework, in partnership with Aon and Howden, which allows us to identify and rate the attributes of our transactions aligned with 6 critical areas: technological transformation, product innovation, protection against extreme weather & disasters, food security, public sector partnerships, and supporting developing economies.

We believe the (re)insurance industry has a unique opportunity to shape the climate agenda. As we continue to build our business, we look forward to driving real progress by building partnerships, innovating boldly, and leading with intent.